i-ONE Bank - 개인고객용

Description of i-ONE Bank - 개인고객용

Customers who want to open a business account for ultra-low interest rate loans for small businesses must use the 'i-ONE Bank for Business' app. You cannot create a business account through this app.

Find the bank that's right for you

I'm The ONE!

i-ONE Bank

(IBK customer center 1588-2588, consultation hours: weekdays 09:00 ~ 18:00)

■ Simple login and easy use

ᅠ• Easy login with pattern, fingerprint, face, etc. without complex co-certificate

ᅠ• If you have a mobile phone, even the first customer of IBK can open an account and sign up for smart banking

ᅠ• All banking operations such as transfer, product subscription, and banking transactions are possible with only the authentication password (6 digits)

ᅠ• Payment of utility bills accurately and quickly with bill OCR photography

■ The home screen that is perfect for you

ᅠ• Composed of 4 themes: asset, product, banking, and card

ᅠ• Composed of 3 themes: Banking, Card, and Product Mall

ᅠ• Inquiry and transfer the balance of your main account on the home screen at once

ᅠ• Provide personalized financial information notifications

ᅠ• Providing customized menus by analyzing financial transaction patterns

■ world fast remittance

ᅠ• (Talk Talk Remittance) Shake your phone anytime, anywhere and tap to send money to a designated account

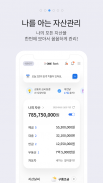

■ My data-based asset management service

ᅠ• (My Assets) Integrate financial information scattered across financial institutions at once

ᅠ• (My Expenditure) Expenditure analysis, target budget/fixed cost management, necessary cost/cash flow management, consumption pattern/card performance management

ᅠ• (My Report) Comprehensive analysis report on net assets, asset distribution, investment income, and liabilities

ᅠ• (Credit Management) Credit score inquiry, detailed change history, custom credit guide, credit score increase

ᅠ• (Real estate) Real estate market price/actual transaction price information, subscription consulting, sales information, real estate calculator

ᅠ• (Asset collection) investment propensity analysis, portfolio recommendation/subscription, non-use challenge product subscription

■ My own card lounge

ᅠ• Check my card information, benefits, finance, and convenience services at a glance

ᅠ• Recommending customized card products by analyzing card usage patterns

■ A product mall that knows me

ᅠ• Customer-specific product recommendation through big data analysis

ᅠ• Providing a big data report analyzing customers with similar financial inclinations

■ Abundant Financial Life

ᅠ• (household account book) check the automatically recorded income/expenditure status and my consumption patterns (automatic records are provided only for Android OS)

ᅠ• (Zero Pay) Easy payment with QR code and up to 40% income deduction benefits

ᅠ• (Gift) Send a mobile coupon to a dear friend/acquaintance

ᅠ• (Dutch Pay) Provides Dutch Pay that divides the common expenses into games or N bread

■ AI secretary chatbot by my side

ᅠ• (Curation) Recommendation of necessary information for each customer by keyword

ᅠ• (Financial transaction) Resolve major banking transactions immediately in the chat window

ᅠ• (Search Menu) You can move directly by saying the desired menu

■ Guide to app permission information

ᅠ① Essential access rights

ᅠᅠ • Phone: Used to collect device information for mobile phone authentication and mobile certificate issuance with access to device information.

ᅠᅠ • Alarms and Reminders: Used to check whether login is linked.

ᅠ② Optional access rights

ᅠᅠ • Address Book: Used to call up contacts when sending SMS after easy remittance or transfer.

ᅠᅠ • Camera: It is used for photographing ID and submitting documents, recognizing QR code when copying co-certificate, photographing Zero Pay QR code, photographing Giro paper, and taking profile picture.

ᅠᅠ • Storage space: Used to save and load certificates, save copies of bankbooks, view ARS, profile settings, and save temporary photos when taking ID cards.

ᅠᅠ • Location: Location information is used to provide banking services.

ᅠᅠ • Microphone: Used for voice search in chatbot and integrated search, and when requesting authentication using sound waves.

ᅠᅠ • SMS: Used to record bank/card text messages to the IBK household account book service and financial transaction notification service.

※ For the smooth use of the app by IBK Industrial Bank customers, we request minimum access rights.

※ You can use the service even if you do not agree to the optional access right, but there may be restrictions on the use of some functions.

※ How to change access rights (setting methods may vary by manufacturer)

ᅠ• Phone settings > Application (app) management > IBK Industrial Bank > Permissions

※ The access rights of the i-ONE Bank app are implemented by dividing them into essential and optional rights in response to Android OS 6.0 or higher. If you are using an OS version less than 6.0, you cannot selectively grant permission, so it is recommended to check if the operating system can be upgraded and upgrade the OS to 6.0 or higher if possible. Also, even if the operating system is upgraded, the access rights agreed to in the existing app do not change, so in order to reset the access rights, you must delete and reinstall the app to set the access rights normally.